Vietnam’s Growing Cosmetics Market: A Lucrative Opportunity

In recent years, Vietnam has witnessed a surge in its cosmetics market. This growth is driven by factors such as rising incomes, heightened demand for beauty products, and the increasing prevalence of online shopping. These trends present significant opportunities for businesses operating in the cosmetics industry.

Global Players Eyeing Vietnam

Both local and international health and beauty retail chains are keenly eyeing the Vietnamese market. Hong Kong-based cosmetics giant Watsons, boasting 12,800 stores globally, marked its entry into Vietnam in January. Guardian, another Hong Kong cosmetics distributor, has successfully established over 90 stores in Vietnam since its inception in 2011.

Local Competitors Respond to Competition

Local personal care chain Medicare, established in 2001, is actively seeking to expand its product range amidst growing competition from international counterparts. Bart Verheyen, the commercial director of Medicare, emphasized the company’s continuous search for new brands seeking exclusive partnerships in the Vietnamese market.

New Entrant Embraces Trends

The upcoming entry of pharmaceutical and cosmetics producer GeneWorld into the market further highlights the momentum. GeneWorld is set to introduce natural cosmetics and organic beauty products, aligning with the current trend towards organic skincare.

Market Potential and Consumer Trends

With Vietnam’s beauty and cosmetics market showing promise, global research firm Nielsen points out key factors contributing to its potential, including the expanding middle class and rising demand from young consumers, including men. Despite the positive outlook, Vietnam’s per capita spending on cosmetics remains relatively low at $4, compared to $20 in Thailand, suggesting untapped market potential.

Changing Consumer Habits

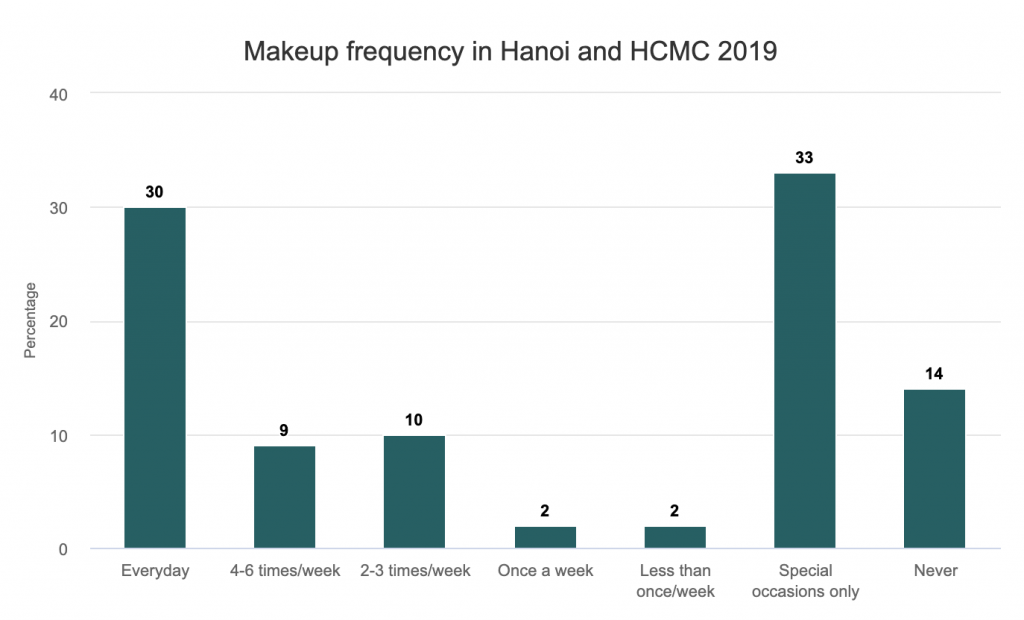

A survey conducted in Hanoi and Ho Chi Minh City by market research firm Q&Me revealed a notable shift in makeup habits. The percentage of people wearing makeup daily has increased to 30%, up from 28% in 2016, while those abstaining from makeup dropped significantly from 24% to 14% during the same period. Lipstick, foundation, and blush emerged as the most popular makeup items.

Conclusion: Strategic Positioning for Growth

In conclusion, Vietnam’s cosmetics market is poised for growth, driven by economic factors and shifting consumer habits. Businesses are strategically positioning themselves to capitalize on this lucrative opportunity, with a focus on expanding product offerings and aligning with emerging trends such as organic and natural beauty products.