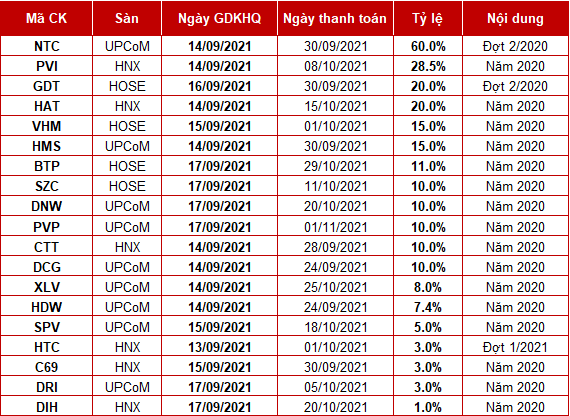

There are 21 enterprises that will do ex-rights transactions to pay dividends in the week of September 13-17, including the big man VHM.

NTC pays cash dividend at the rate of 60%

Holding the highest dividend payout ratio is Nam Tan Uyen Industrial Park (UPCoM: NTC). On September 30, NTC will pay the 2020 cash dividend at the rate of 60%. Last date for registration is September 15. With approximately 24 million shares outstanding, it is estimated that NTC needs to spend nearly VND 144 billion for this dividend.

Previously, at the end of January 2021, NTC paid the 2020 cash dividend at the rate of 60%, and also awarded shares to existing shareholders at the ratio 2:1.

Looking back at NTC’s business results in the first 6 months of 2021, net revenue increased by 38% over the same period, reaching more than VND 127 billion. Gross profit margin increased from 64% to nearly 71%, helping the Company’s gross profit increase by 52%, reaching more than 90 billion dong. Although expenses decreased, but due to the decrease in financial revenue, profit after tax in the first half of 2021 only increased by 16% over the same period, at nearly VND 164 billion. However, with this profit, NTC has achieved more than 72% of the profit target for the whole year of 2021 according to the plan approved by the Annual General Meeting of Shareholders.

NTC shares closed the session on September 10 at 207,900 VND/share.

PVI is preparing to pay 2020 dividend at the rate of 28.5%

One company that also pays a high dividend is PVI (HNX: PVI). In more detail, on October 8, PVI will pay the 2020 dividend in cash at the rate of 28.5%. The ex-rights date is September 14.

With more than 223.5 million shares outstanding, it is estimated that PVI needs to spend more than VND 637 billion for this dividend payment. This is PVI’s largest dividend payout ever.

Taking a look at PVI’s business results in the first 6 months of 2021, the Company’s net revenue reached nearly VND 2,484 billion, an increase of more than 3% over the same period, all of which came from insurance business. Since other expenses and revenue did not change significantly during the period, PVI’s net profit increased by more than 2% to more than VND 441 billion.

VHM pays 2020 dividend at the rate of 45%

On September 16, 2021, Vinhomes (HOSE: VHM) will close the list of shareholders who will be paid dividends in 2020 in cash and shares at the rate of 45%. Ex-rights date (GDKHQ) is September 15, 2021. In which, 15% is paid in cash, ie shareholders owning 1 share will receive 1,500 VND. Payment date is October 1, 2021.

Simultaneously, VHM will issue more than 1 billion shares to pay dividends, equivalent to 30%, which means that shareholders owning 1,000 shares will receive 300 new shares. After the additional issuance, the charter capital of VHM is expected to increase from VND 33,495 billion to nearly VND 43,544 billion.

Regarding business results in the first 6 months of 2021, VHM recorded VND 41,711 billion in revenue and VND 15.629 billion in net profit, up 82% and 52% respectively over the same period. In 2021, VHM sets a target of VND 90,000 billion in revenue and VND 35,000 billion in profit after tax. Thus, after the first half of the year, the Company has fulfilled 46% of revenue target and 45% of profit target.

On HOSE, VHM shares closed the session on September 10 at 107,500 VND/share.

In addition to VHM, two other companies that are also trading without the right to pay dividends in shares next week are C4G (ratio 100:6) and CRE (ratio 100:10).

Trans: Fili